are delinquent taxes public record

Once a property tax bill is deemed delinquent after March 15 of each year the debt goes into execution and the County Treasurer sends the. 9 am4 pm Monday through Friday.

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Credit reporting agencies may obtain and publish the.

. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Pacific Time Monday through Friday excluding Los Angeles County holidays. Access to Public Records Public records access is a part of Westmoreland Countys ongoing effort to provide easy and enhanced delivery of county information and services.

44 North San Joaquin St 1st Floor Suite 150 Stockton CA 95202. Last Known Mailing Address. If you have paid your bill in full and have not received your tax lien release you may contact us at unsecuredttclacountygov or 213 893-7935 between 800 am.

View the tax delinquents list online. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. At that point you could take possession of.

When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. View detailed information about upcoming San Joaquin County public auction tax sale results of the previous tax sale and list of excess proceeds from the prior auction. 3 Oversee property tax administration.

Find Tax Records including. Once a lien is filed the taxpayers credit rating could be harmed and in most cases property cannot be sold or transferred until the past-due tax is paid. 2020 XLSX 2019 XLSX 2018 XLS 2017 XLS 2016 XLS 2015 XLS 2014 XLS 2013 XLS 2012 XLS 2011 XLS 20022010 XLS 19942001 XLS.

Child Support Case Manager. Top 10 Delinquent Individuals. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

NJ Property Tax Records In South River NJ. Michigan Ave Saginaw MI 48602 Additional County Office Locations. Email your request to.

Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. Return to the IRS Data Book home page. Search Arkansas County property tax and assessment records by owner name parcel number or address.

Tax Delinquents Public Disclosure. Contact for View the Public Disclosure Tax Delinquents List. You may make a Public Records Request for available Department of Revenue records by using one of the following options.

101 Court Square Dewitt AR 72042. Of Local Services Gateway. For questions contact Tax Assessment.

The information displayed reflects the. Assessor Phone 870946-2367 Fax 870946-1795. To pay your sewer bill on line click here.

Eventually the lien owners may have to force foreclosure on the property to pay the liens. In addition to the tax return and account transcripts available through the Get Transcript tool you may also request wage and income transcripts and a verification of non-filing letter. In prior editions of the IRS Data Book Table 25 was presented as Table 16.

Showing results 1 through 250 out of 19349. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 23 2021.

And maintains an accurate up-to-date account of monies collected. Please be advised that we only. If you have attachments please use another method.

105-3651 b 1. Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Florida Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in FL.

A lien filed at a county Register of Deeds becomes a public record. Show only delinquent taxpayers with revoked licenses. Tax Records include property tax assessments property appraisals and income tax records.

Assessor Collector and Delinquent Taxes. Send a completed Form 4506-T. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request.

You may enter search terms in any combination of fields. Certain Tax Records are considered public record which means they are available to the public while some Tax. Arkansas County Assessor and Collector.

Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. Send a fax to 360-534-1606. No cash may be dropped off at any time in a box located at the front door of Town Hall.

2 N Main Street. Delinquent Taxpayer Publication - This publication lists delinquent taxpayers with prior year delinquent taxes. Delinquent Collection Activities by Fiscal Year.

Public Auction Tax Sales. Name Doing Business As. If left unpaid the liens are sold at auctions to the public.

Use this online form if you do not have to include any attachments. Delinquent tax records are handled differently by state. Tax Department Call DOR Contact Tax Department at 617 887-6367.

The Delinquent Tax Division investigates and collects delinquent real and personal property taxes penalties and levy costs. Tax payments checks only. Texas property tax records.

A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. Top 100 Delinquent Taxpayer - This lists the top 100 delinquent taxpayers for the current fiscal year. Seminole County Tax Collector PO Box 630 Sanford FL 32772-0630 407 665-1000 Email Contacts Email Public Records Custodian.

We will issue a tax lien release once your Unsecured Property Tax Bill is paid in full. Delinquent Property Tax Search. Finds and notifies taxpayers of taxes owed.

Tax Records include property tax assessments property appraisals and income tax records. Displaying properties 1 - 150 of 7084 in total. Current Real EstateDelinquent Taxes.

NAME AMOUNT CITY STATE TOM SENG 283258500.

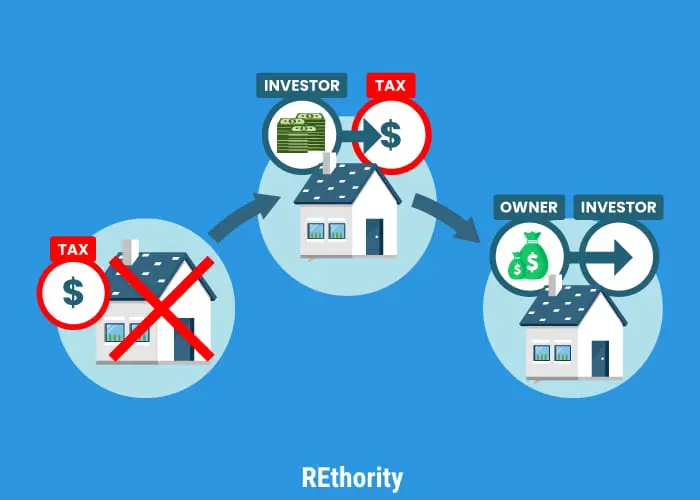

How To Find Tax Delinquent Properties In Your Area Rethority

Detroit Real Estate 15491 Lauder St Detroit Mi 48227 Renting A House House Construction Builders

Notice Of Delinquency Los Angeles County Property Tax Portal

How To Buy A Property With Delinquent Taxes New Silver

Delinquent Tax Sale Surplus Sale

Harris County Officials Publish List Of Delinquent Taxpayers Houston Public Media

How To Find Tax Delinquent Properties In Your Area Rethority

2020 Lucas County Auditor Delinquent Land Tax Notices The Blade

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Everything You Need To Know About Getting Your County S Delinquent Tax List Retipster

Delinquent Taxes Oldham County Clerk

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Taxes Oldham County Clerk

Pin By Amy Craft On Realtor Need To Know Real Estate Business Homeowner Property Tax

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know